Medicare

HEALTH INSURANCE FOR SENIORS AND THE DISABLED.

Medicare is oftentimes confused with Medicaid but they are very different. It was originally designed to provide coverage to people on Social Security.

Medicare

HEALTH INSURANCE FOR SENIORS AND THE DISABLED.

Medicare is oftentimes confused with Medicaid but they are very different. It was originally designed to provide coverage to people on Social Security.

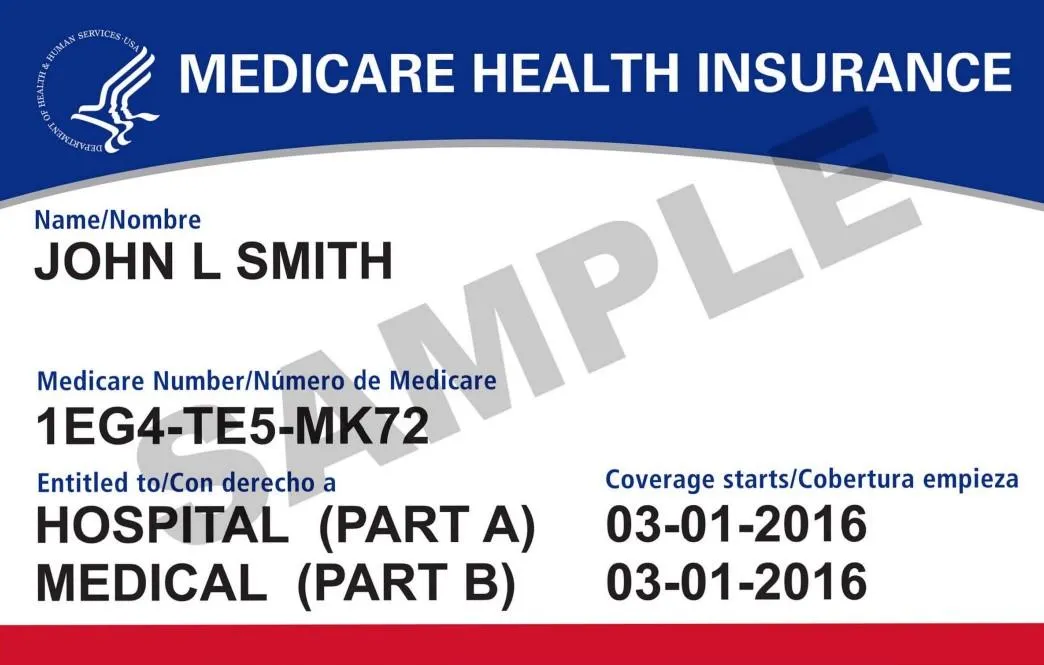

Medicare Parts A & B are included in Original Medicare,

they provide coverage for inpatient & outpatient benefits, respectively.

Medicare Part A

(Hospital Insurance) helps to pay for hospitals, hospice, home health care and skilled nursing facility.

Medicare Part B

(Medical Insurance) helps to pay for physician, diagnostic, preventive & outpatient services.

Medicare Part C

(Medicare Advantage) covers all services that Original Medicare covers and it stands in place of Original Medicare. These plans offer extra coverages like vision, dental and hearing.

Medicare Part D

(Prescription Drug Coverage) are stand-alone or Medicare Advantage Prescription Drug plans sold by insurance carriers contracted with Medicare.

WHEN TO ENROLL IN MEDICARE

If you are already receiving benefits from the Social Security Administration (SSA) or the Railroad Retirement Board (RRB), you will automatically get Medicare Part A and Medicare Part B beginning the first day of the month you turn 65.

ENROLLING IN MEDICARE AT 65

If you are close to 65 and not yet receiving Social Security or Railroad Retirement Benefits you will have to enroll during your Medicare Initial Enrollment Period (IEP). You may contact Social Security during the 7-month window that includes your 65th birthday month, the 3 months before and the 3 months after. If you worked for a railroad remember to contact the RRB.

MISSING THE INITIAL ENROLLMENT PERIOD

If you don’t enroll in Medicare when first eligible, and you don’t qualify for a Special Enrollment Period (SEP), you can sign up during the General Enrollment Period (GEP). The General Enrollment Period is spans from January 1-March 31 each year. Your coverage will not start until July 1.

CHOICES FOR MEDICARE-ELIGIBLE INDIVIDUALS CURRENTLY IN A EMPLOYER GROUP HEALTH PLAN

MEDICARE WHEN WORKING PAST AGE 65

If you plan to keep working, you still have a 7-month Initial Enrollment Period (IEP) when you turn 65. If you qualify to delay both Medicare Parts A & B, you can do so without penalty as long as you enroll within 8-months of either losing your or your spouse’s employer group health coverage. Enroll during the 8-month Special Enrollment Period (SEP) and provide proof of creditable prescription drug coverage to avoid a Part D penalty.

HAVING CREDITABLE DRUG COVERAGE

Before you delay Medicare be sure that you have creditable prescription drug coverage. Your or your spouse’s employer group health coverage must be as good as the standard Medicare Part D plan coverage. If your employer’s drug coverage isn’t creditable, you will need to enroll in a plan during your Initial Enrollment Period (IEP) to avoid a Part D penalty.

FREQUENTLY ASKED QUESTIONS (FAQ)

WHAT IS ORIGINAL MEDICARE?

Original Medicare consists of Medicare Part A (hospital coverage) and Medicare Part B (medical coverage). It’s a federal health insurance program for individuals 65 or older; under 65 who have a qualifying disability; and of any age with a diagnosis of End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS, also called Lou Gehrig’s disease).

WHAT IS ORIGINAL MEDICARE PART A?

Original Medicare Part A is hospital coverage. It helps pay for hospital stays and inpatient care in hospitals.

WHAT IS ORIGINAL MEDICARE PART B?

Original Medicare Part B is medical coverage. It helps pay for doctor visits and outpatient care.

IS MEDICARE THE SAME AS MEDICAID?

No. Medicare and Medicaid are both government programs that help people pay for health care, but they are not the same thing.

Medicare is a federal program that provides health care coverage for people who are 65 or older or have certain qualifying disabilities.

Medicaid is a joint state and federal program that provides health care coverage for individuals and families with limited incomes. “Dual eligibility” means you qualify for both Medicare and Medicaid.

CAN I GET MY PRESCRIPTION DRUGS COVERED UNDER ORIGINAL MEDICARE?

No. Original Medicare doesn’t cover prescription drugs. Part A may cover some drugs you get as an inpatient. Otherwise, prescription drug coverage, also known as Medicare Part D, is available separately through private insurance companies approved by Medicare. You can get prescription drug coverage either through a stand-alone Part D plan (PDP) or a Medicare Advantage plan (MAPD) that includes prescription drug benefits.

DOES ORIGINAL MEDICARE COVER VISION, DENTAL, OR HEARING CARE?

Generally, no. Original Medicare doesn’t cover routine vision or dental care, eyeglasses, or hearing aids. Part B may cover some dental or vision services if you meet certain conditions and they are considered medically necessary, but you’ll have to check with your health care provider and Medicare first. Many Medicare Advantage (Part C) plans, however, do offer these benefits. Be sure to compare the benefits of all plan options to find the coverage that best fits your needs.

DOES ORIGINAL MEDICARE PAY FOR A NURSING HOME STAY?

Original Medicare Part A pays for some skilled nursing services, but doesn’t cover long-term or custodial care (daily life activities like eating and bathing). You’d also still be responsible for a portion of the costs, such as deductibles, copays and coinsurance.

WHEN AM I ELIGIBLE FOR ORIGINAL MEDICARE?

You’re eligible for Original Medicare once you turn 65 and are a U.S. citizen or legal resident. If you’re a legal resident, you must have lived in the United States for at least five years in a row before you’re eligible for Original Medicare.

I’M NOT 65 YET. COULD I STILL BE ELIGIBLE FOR ORIGINAL MEDICARE?

Even if you haven’t turned 65, you may be eligible to get Original Medicare. You need to be a U.S. citizen or legal resident for at least 5 years in a row, and have one of the conditions below:

Under 65 and have a qualifying disability

Any age and have Amyotrophic Lateral Sclerosis (ALS, also called Lou Gehrig’s disease) or End-Stage Renal Disease (ESRD).

AM I ELIGIBLE FOR A MEDICARE ADVANTAGE OR MEDICARE PRESCRIPTION DRUG PLAN?

Yes—but you have to enroll in Medicare Part A and/or Part B.

For a Medicare Advantage (Part C) plan, you must have both Medicare Part A and Part B to apply.

For Medicare Part D prescription drug plans, you need to first enroll in either Medicare Part A or Part B. You cannot be denied enrollment in a Part D plan. You must enroll in a Part D plan during your Initial Enrollment Period to avoid the late enrollment penalty for Part D. The exception to this rule is if you qualify for a Special Enrollment Period.

Medicare

HEALTH INSURANCE FOR SENIORS AND THE DISABLED.

Medicare is oftentimes confused with Medicaid but they are very different. It was originally designed to provide coverage to people on Social Security.

About Us

Medicare

Insurance

Disability

Long Term Care

Income Annuities

Blog

Call Today: +1 844-515-0754

Email Us: [email protected]

Copyright © 2024

is an Insurance Company

All Rights Reserved.